We have now come to the end of this crackling 2025, full of news and unexpected facts that have lit the fuse igniting the industry. Before we wait for the latest information about the last quarter of the year, it is worth taking a closer look at how the watch market performed in the July-September period. Against all expectations, the secondary market recorded a sharp increase in sales, a sign of growing appreciation by attracting customers to discontinued models and established references in the world of second wrist.

The market against U.S. tariffs and rising prices.

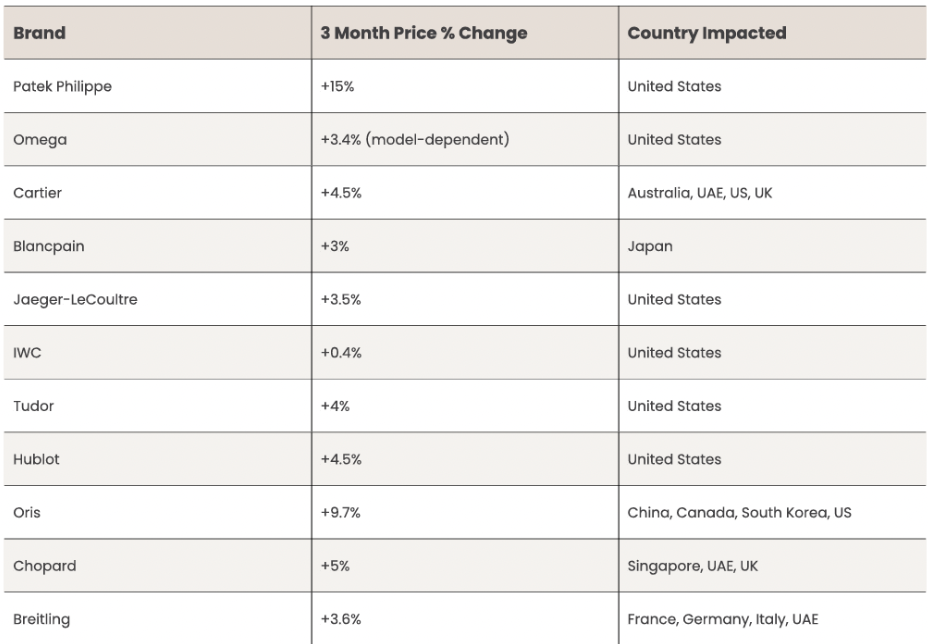

Two factors seemed destined to slow the industry’s growth. In August , the United States raised duties to 39 percent on Swiss watches, hitting one of the most important export markets.

Reaction of brands to the introduction of duties – Credits: EveryWatch

This was compounded by a general increase in price lists by brands. The combined effect, however, led to an unexpected result. Instead of curbing demand, it moved it forcefully toward the secondary.

Price increase in Q3 2025 – Credits: EveryWatch

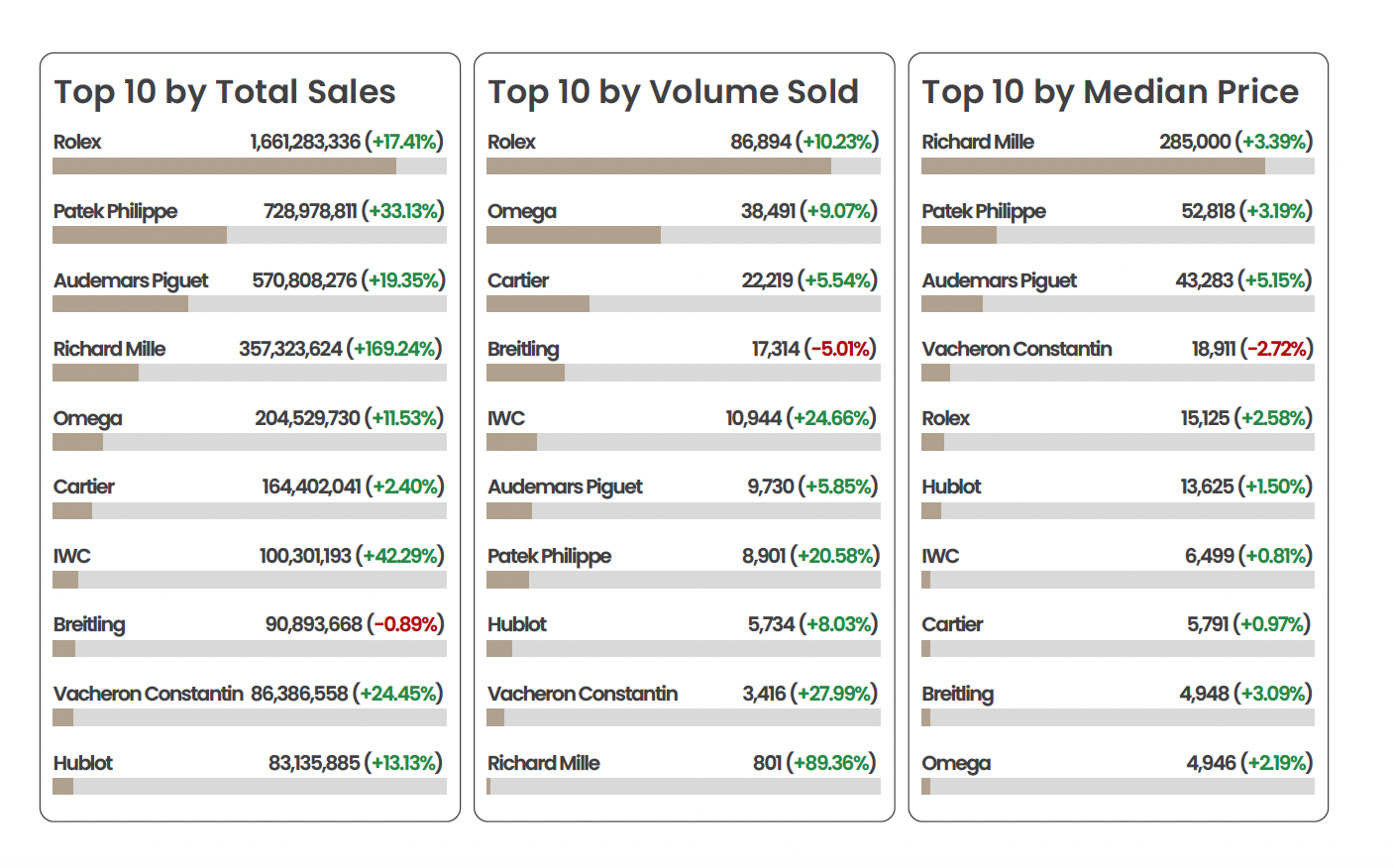

Among the 60 brands analyzed by EveryWatch, 43 saw an increase in sales and 47 saw an increase in the median price of their models. Patek Philippe is the most emblematic case. After

Ranking of top 10 brands by sales, volume and median price – Credits: EveryWatch

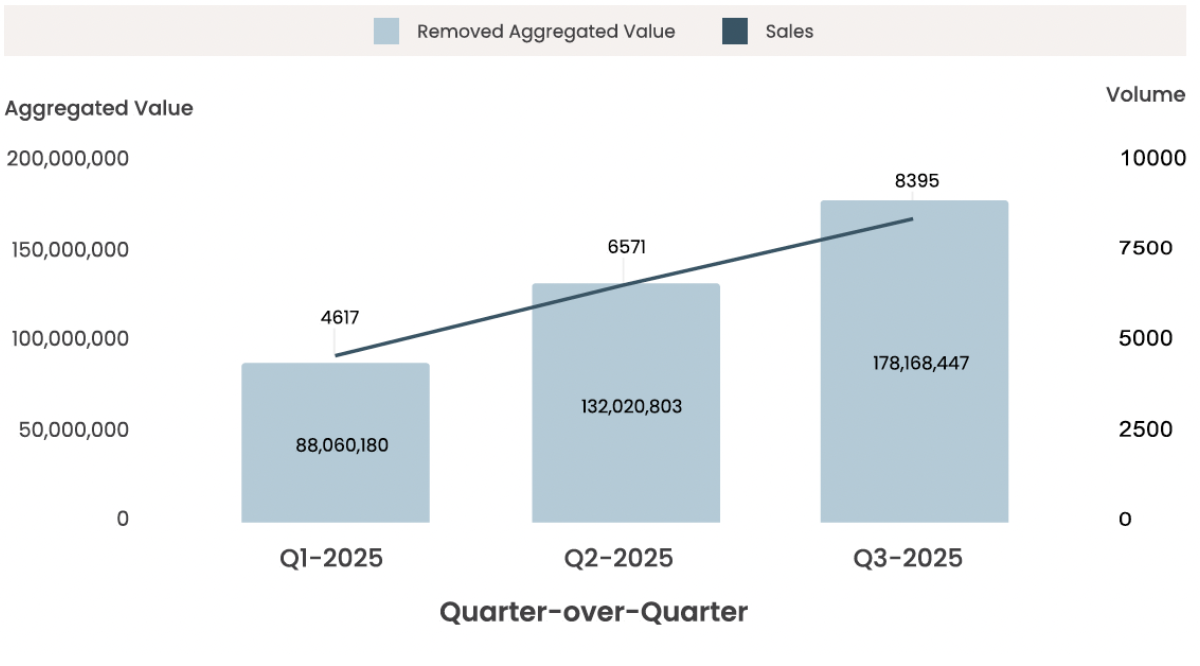

This momentum is also clearly reflected in Rolex’s CPO program. Between Q1 and Q3, the maison’s certified pre-owned sales increased from $88 million to $178 million, more than doubling. Official authentication, combined with the transparency of the process, has further solidified customer trust.

Rolex CPO trend – Credits: EveryWatch

A “living” market

Looking at the data as a whole, the picture is one of a lively and responsive market, eager to leave behind years marked by speculation and a bubble that had driven many enthusiasts away. The secondary market closed the quarter at +23.8 percent over Q2. In such a scenario,

Ranking by total value of sales in Q3 2025 – Credits: EveryWatch

Independents: a new frontier?

Independent watchmaking is experiencing a moment of structural growth. Creativity not constrained by industrial logic, limited production, technical care, and a strong identity have won over an increasingly broad audience, which sees in these realities an authentic and profoundly different alternative to the offerings of traditional brands.

Value of independent watch sales Q3 2025- Credits: EveryWatch

Q3 data confirm its strength. In the $0-20,000 range, which represents the hard core of the overall market, independents ended a particularly solid September. Total sales value grew +22.4 percent from the previous month, and the median price increased +10.9 percent. Since the beginning of the year, the independent segment shows an overall growth of around +20%.

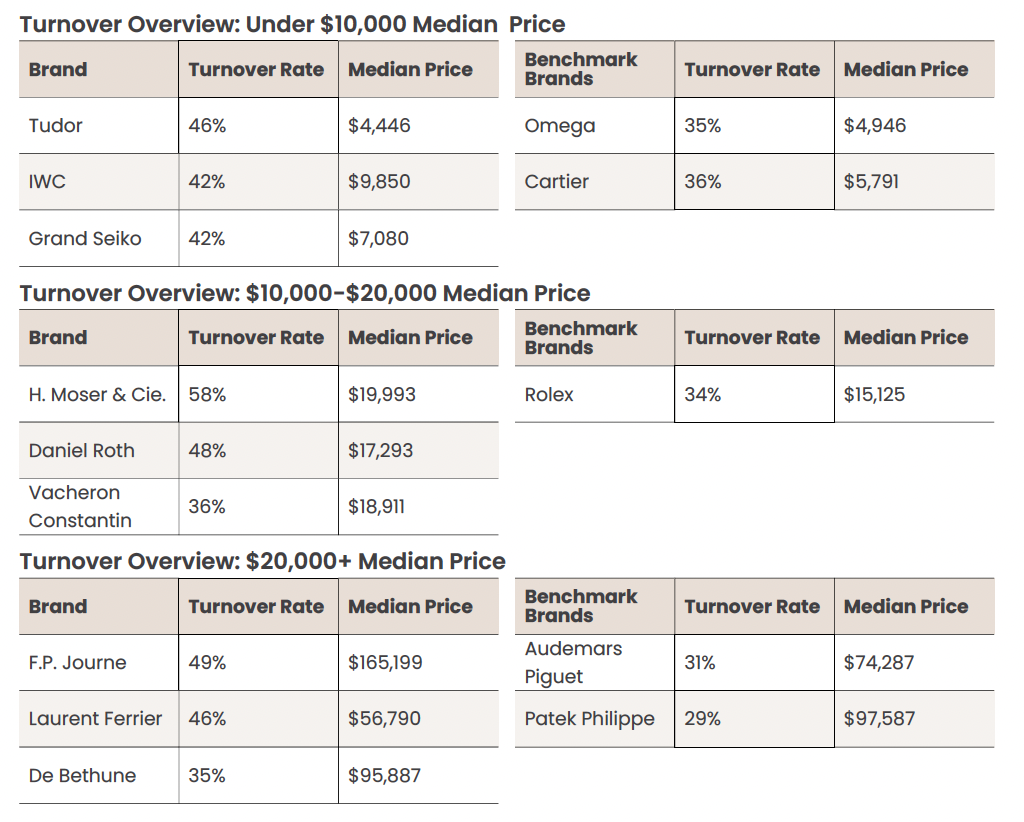

Even more telling are the turnover rates. Under

Turnover by price range – Credits: EveryWatch

The trend by price range

Analyzing growth by price range, therefore, reveals a market in turmoil:

- 0-20,000 range: remains the most robust, supported by a cross-section of audiences and continued interest in affordable but quality models.

- US$20-100,000 range: experiencing a resurgence of attention instead, driven by “affordable” complications, discontinued models, and highly sought-after references from brands such as Omega, Cartier, and Tudor.

- Band over $100,000: a historically more volatile segment, a clear return of capital is observed: volumes grow between 33% and 47% on a quarterly basis.

This is a sign that the entire market, in every bracket, is being traversed by solid and diversified demand.

Brands leading the ranks

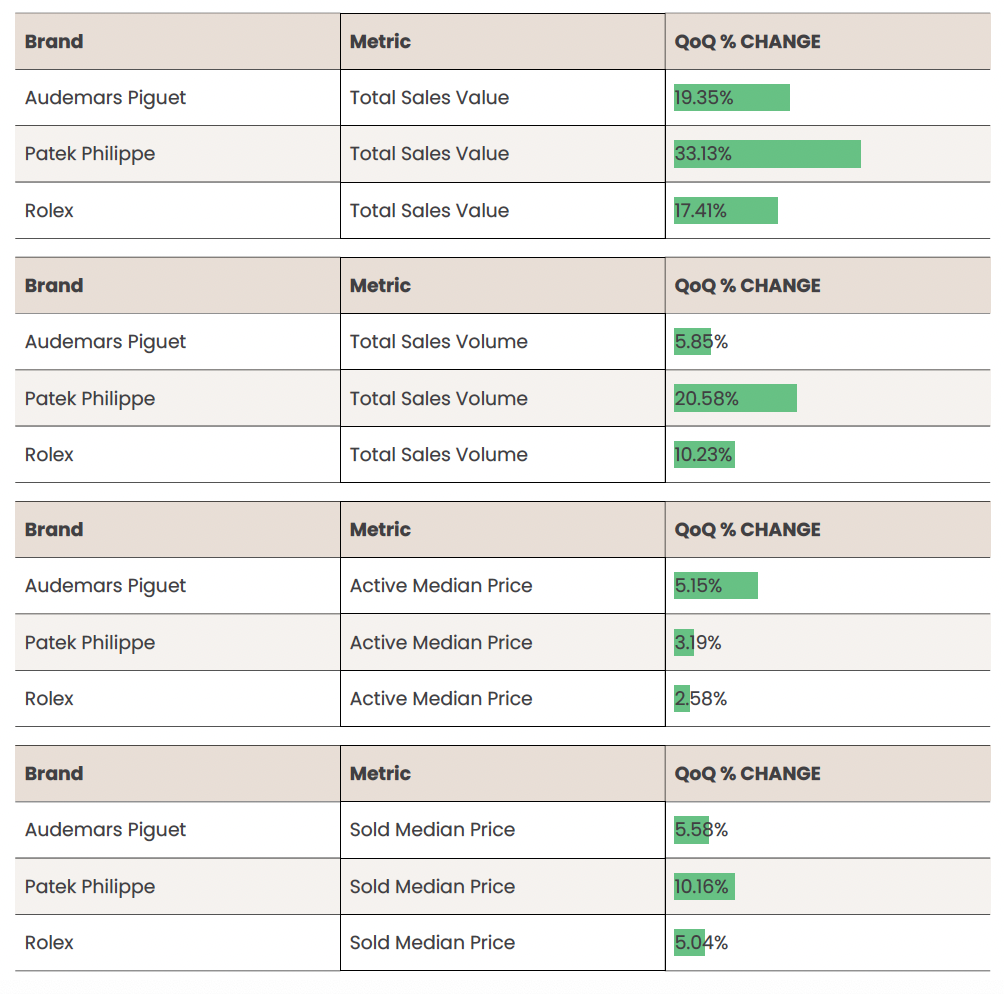

As much as independents are having a golden moment, as we have seen in volumes the big traditional brands continue to dominate the market. Patek Philippe leads the quarter’s growth with +33%, followed by Audemars Piguet with +19%, while Rolex remains an unmatched behemoth: $1.66 billion in sales in Q3 alone. Their combined weight still remains the industry’s leading benchmark.

Performance by the Big Three – Credits: EveryWatch

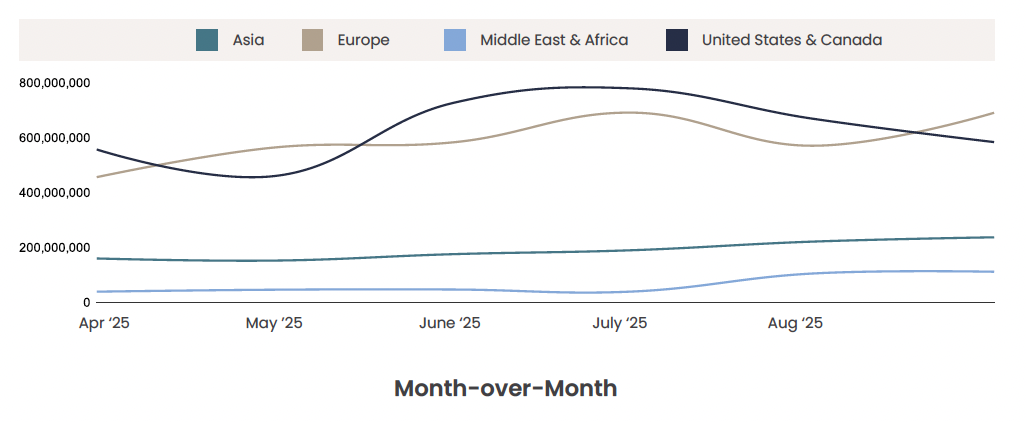

How does the market move around the world?

As mentioned earlier, geographically the quarter shows an increasingly diversified secondary market. Europe once again takes center stage, surpassing the United States in overall value. Asia shows an impressive acceleration: in just a few months, volumes rise from 18,000 to over 31,000 pieces, with Hong Kong and Singapore leading the way with a sharply rising sales pace and an average sales time down to 56 days. The Middle East, for its part, is experiencing an exceptional quarter, with value almost tripling from previous months. The overall picture is one of an extremely vibrant global market, with different geographic poles contributing in a balanced way to overall growth.

Secondary market trends around the world – Credits: EveryWatch

How did the auctions go?

The auction world also offers interesting signs. Some references attracted surprising attention. The de Grisogono Luna went for $1.05 million, exceeding estimates by 779%. The

Auction results – Credits: EveryWatch

Visit our Youtube channel to experience the best of the world of watchmaking firsthand.

For all real-time updates follow us on Instagram.